|

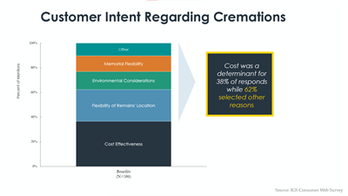

On April 28th I had the pleasure of joining CANA, my Foundation Partners colleagues and two of our partners in an incredibly informative webinar entitled, Meeting Families Where They Are: How to Leverage Cremation Trends to Your Advantage. I was very impressed with the practical and actionable advice and solid tips shared by our presenters. What I also found interesting was the wide range of cremation experience among the more than 220 CANA members who registered for the event. Nearly 20 percent of registrants are relatively new to the cremation space, with cremation representing less than 25 percent of their current business, while another 18 percent are fully invested in cremation services, which make up more than 85 percent of their business. Wherever they fall on the cremation business spectrum, they received valuable takeaways that will help them fine-tune and advance their businesses. And the good news is you can too by viewing a recording of the webinar here. First, however, I wanted to share a few highlights of the session and my take on the lessons learned. THE CREMATION VALUE PROPOSITIONOur Foundation Partners Group CFO Tom Kominsky kicked things off with a review of the value proposition around cremation and the flexible options and revenue opportunities associated with cremated remains. He began by debunking the popular belief that cost is behind the growing preference for cremation. He cited a recent survey of our cremation families, in which simplicity was almost as important as cost when selecting cremation. Flexibility and environmental concerns were also important considerations.  That said, Tom went on to acknowledge that increasing cremation rates present challenges for many funeral homes and he outlined a number of opportunities to mitigate the financial risk. They include the sale of jewelry products made of and for cremated remains, and upscale options for permanent memorialization. He also discussed optional services, like catering and additional car rentals, that can drive up average cremation revenues. I wholeheartedly agree with Tom’s assessment, which is supported by research showing that ancillary product and service offerings for cremation families represent a massive opportunity for funeral home owners. The findings he shared about environmental concerns also resonated with me. As managers and owners of funeral service businesses, we need to be keenly aware of this environmental trend and look for ways to weave environmental responsibility into the fabric of our operations. Funeral home owners who recognize and stay ahead of the growing environmental movement will be well-positioned for success. That’s why we were proud to announce that all cremations across Foundation Partners locations will be carbon neutral this year, thanks to a new carbon offset program we implemented through Terrapass to support projects across North America that reduce carbon in the atmosphere. THREE KEYS TO CREMATION BUSINESS SUCCESSMeredith Waterston, a third-generation funeral director with the Cremation Society of Minnesota, shared three keys to her family’s cremation business success.

We’re extremely proud of our partnership with the Cremation Society of Minnesota and look forward to partnering with more cremation-forward funeral homes in the Midwest and throughout the country. THE SEISMIC SHIFT TO ONLINE SHOPPINGWe all know that the pandemic has accelerated the flight to online shopping but educating families and selling funeral services online requires a new mindset and a new approach. Angelique Simpson, professional development director for Matthews Aurora Funeral Solutions, offered tips to prepare your teams for the changing demands and expectations of today’s families, and illustrated how your average revenue per contract has the potential to increase when you have an effective online portal. Her advice ranged from why it’s imperative that your staff be knowledgeable in every aspect of your online offering, to making sure that your online platform enlists large clear photo images of all of the best products and services you have to offer. According to Angelique, the key to successfully advancing your business is investing in your team with professional development. Making the shift from face-to-face family meetings to online chat and telephone communications requires training. Our own, Foundation Partners experience bears this out. Like most of you, pandemic lock-downs required our teams to make pre-need and at-need arrangements over the phone or online. And state and local restrictions that limited gatherings prompted us to reassess our tools for remote attendance. Updating our e-commerce capabilities and bringing on new remote attendance systems required an efficient operational plan and a huge training effort that reached each of our 160 locations across the country. ACTIVATE YOUR TEAMS AROUND THE SHIFT TO CREMATIONAt Foundation Partners, we take a three-step approach to rolling out new tools and procedures in our funeral homes: Pilot, Listen and Adapt. Pilot – We identify offerings that are resonating in the market and test them in select locations. We partner with vendors and have them educate our teams to test new items. And then we incentivize our teams to offer these new products and services to families. Listen – We ask our funeral home team members for feedback as they present different options to families. What’s working? And what’s not working? Adapt – As we learn what is and is not resonating with our families, we adapt to meet their needs. This is something you can do within your locations, regardless of the size of your business. BUILD, OUTSOURCE AND PARTNERI’d like to leave you with these final thoughts that I shared with the professionals who attended the webinar. As leaders of our organizations, it’s our job to make sure we have the right organizational structure and the capital in place to adapt to the changing market. The way I see it, we have three options.

If you’re thinking about succession planning, now is the perfect time to arrange a complementary, confidential financial analysis with Foundation Partners Group. Click here to request a call or call Jason Widing, our vice president of business development at (503) 200-0605

The first cremation in the United States took place in 1876 in Washington, Pennsylvania. Nearly 100 years later in 1972, the national cremation rate was 5%. A mere 45 years later in 2016, the national cremation rate exceeded 50%. During that period of growth, the cremation rate grew predictably and steadily between 1-2% a year. Consumers have driven this trend in recent history and the profession has tried to keep up with their preferences. Since they are in charge, it’s important for us to understand why they are choosing cremation and what their experience is. CANA'S ANNUAL CREMATION STATISTICSWe talk a lot in this profession about change. A lot of people don’t like change and aren’t comfortable with it, and some in the industry have been slow to change. Over the years many funeral directors and cemeterians have cited “cremation” as the primary threat to their businesses, however cremation is merely a form of disposition. What they are referencing is a business model that assumes cremation is equivalent to “direct cremation,” or one that is dependent on casket or vault sales to succeed. As cremation rates climb, these businesses experience declining revenue and profits. However, cremation is not going anywhere so those who have not yet adapted need to do so immediately in order to stay relevant and profitable. CANA has a proven history of over two decades of tracking, projecting and just plain getting it right when it comes to statistics. Benchmarking is the primary use of statistics like this. Business owners look at their cremation rate compared to state and county rates to measure market share and track their competition. These data can also be useful when seeking financing for growth or setting value of a business. But cremation rates and numbers are only part of the picture and raise new questions. Why have cremation rates grown at different speeds across the country? Why are consumers choosing cremation? the milestone project As the cremation rate began approaching 50% nationally, CANA embarked on new research to learn more about what is behind the numbers. We evaluated consumer trends and used US census data, demographics, and the Pew Religious Landscape Study and overlayed all of this data with the cremation rates. For this research we focused solely on the US as comparable census data was unavailable from Canada. Once you know a bit more about the cremation rate in your state and the surrounding states, it’s time to understand why some people choose cremation faster or slower than others in the community. We’ve all heard about the cremation consumer. But that person doesn’t live in one section and then you go after them and serve them. They live everywhere in all communities and in all states. How can we connect with consumers if we are speaking different languages? This post highlights some of the language disconnects uncovered during the research. The Pew Religious Landscape Study revealed that the fastest growing portion of Americans were those who claimed no affiliation with organized religion. They answered “none” when asked for their affiliation and have been referred to as Nones ever since. Through this milestone project we confirmed that women are making the cremation decision. Additionally, if there is no religious affiliation we know there is a greater chance they will select cremation. We also know this happens in the preneed sale as well. key findings

cana's 2020 cremation statisticsDuring the height of the first wave of the pandemic, restricted to a social distance, afraid of an unknown disease, and with the dead coming too quickly for some hotspots to handle, many predicted that cremation rates would skyrocket. After all, cremation satisfies a lot of criteria: it allows for the remains to be present at a future service, purifies the remains from disease and pathogens with fire, and reduces a large box to a small box more convenient for storage and transport. We asked ourselves what this meant for all of our research. We had studied growth rates, demographics, conducted focus groups and poured over more than 20 years worth of data – did any of it still count when everything else had been upended? CANA’s analysis as presented in the 2021 Annual Statistics Report says it does. At our request, our statistical consultant checked the data over and over again but found that the cremation rate actually slowed from previous years down from 1.6% growth to just 1.5%. Despite the excess deaths and the gathering restrictions, the cremation rate followed a predicted growth rate. CANA Members will get to see for themselves soon when the Report is released. Despite a challenging year, the changes that funeral service faces are predictable, measurable, and something professionals can face head on. This post is excerpted from the second edition of Fires of Change: A Comprehensive Examination of Cremation by Dr. John B. Fritch coming out later this year. CANA Members can read CANA’s Annual Statistics Report in the forthcoming issue of The Cremationist coming to a mailbox near you in the next three weeks. Members can log in and access the full statistics report archives with your member credentials. Not a member yet? Join to access this research and much more.

|

The Cremation Logs Blog

Cremation experts share the latest news, trends, and creative advice for industry professionals. Register or log in to subscribe and stay engaged with all things cremation. Categories

All

Archives

July 2024

|

|